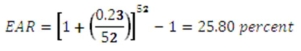

-You are considering two loans.The terms of the two loans are equivalent with the exception of the interest rates.Loan A offers a rate of 7.75 percent,compounded daily.Loan B offers a rate of 8 percent,compounded semi-annually.Which loan should you select and why?

A) A;the effective annual rate is 8.06 percent.

B) A;the annual percentage rate is 7.75 percent.

C) B;the annual percentage rate is 7.68 percent.

D) B;the effective annual rate is 8.16 percent.

E) The loans are equivalent offers so you can select either one.

Correct Answer:

Verified

Q81: What is the annual percentage rate on

Q84: What is the effective annual rate of

Q86: You just paid $750,000 for an annuity

Q87: You would like to establish a trust

Q91: You have $5,600 that you want to

Q92: Your credit card company charges you 1.65

Q99: You are paying an effective annual rate

Q107: This morning,you borrowed $9,500 at 8.9 percent

Q116: On this date last year,you borrowed $3,400.You

Q119: John's Auto Repair just took out a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents