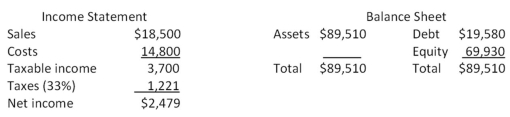

-The most recent financial statements for Last in Line,Inc.are shown here:

Assets and costs are proportional to sales.Debt and equity are not.A dividend of $992 was paid,and the company wishes to maintain a constant payout ratio.Next year's sales are projected to be $21,830.What is the amount of the external financing need?

A) $12,711

B) $13,333

C) $13,556

D) $13,809

E) $14,357

Correct Answer:

Verified

Q43: Frasier Cabinets wants to maintain a growth

Q46: A firm has a retention ratio of

Q48: A Procrustes approach to financial planning is

Q50: The financial planning process tends to place

Q53: The Cookie Shoppe expects sales of $437,500

Q54: The financial planning process:

I.involves internal negotiations among

Q56: Fresno Salads has current sales of $6,000

Q60: Miller Bros.Hardware is operating at full capacity

Q61: Consider the income statement for Heir Jordan

Q71: Why do financial managers need to understand

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents