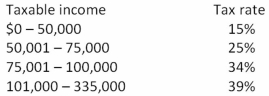

Boyer Enterprises had $200,000 in 2011 taxable income.What is the firm's average tax rate based on the rates shown in the following table?

A) 28.25 percent

B) 30.63 percent

C) 32.48 percent

D) 36.50 percent

E) 39.00 percent

Correct Answer:

Verified

Q64: The 2010 balance sheet of The Beach

Q65: During 2011,RIT Corp.had sales of $565,600.Costs of

Q66: Discuss the difference between book values and

Q67: At the beginning of the year,a firm

Q72: Webster World has sales of $12,900,costs of

Q75: Adelson's Electric had beginning long-term debt of

Q76: Dee Dee's Marina is obligated to pay

Q77: Suppose you are given the following information

Q78: The Widget Co.purchased new machinery three years

Q80: As long as a firm maintains a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents