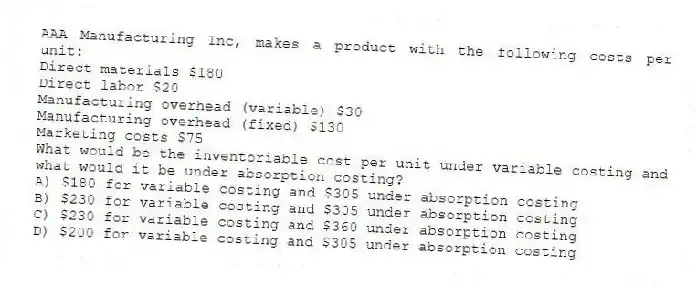

AAA Manufacturing Inc, makes a product with the following costs per unit:

Direct materials $180

Direct labor $20

Manufacturing overhead (variable) $30

Manufacturing overhead (fixed) $130

Marketing costs $75

What would be the inventoriable cost per unit under variable costing and what would it be under absorption costing?

A) $180 for variable costing and $305 under absorption costing

B) $230 for variable costing and $305 under absorption costing

C) $230 for variable costing and $360 under absorption costing

D) $200 for variable costing and $305 under absorption costing

Correct Answer:

Verified

Q14: Fast Track Auto produces and sells an

Q15: Under absorption costing, fixed manufacturing costs _.

A)

Q16: In _, fixed manufacturing costs are included

Q17: Which of the following best describes how

Q18: Time Again, LLC produces and sells a

Q20: _ is a method of inventory costing

Q21: For 2017, Rockford, Inc., had sales of

Q22: Which of the following would be subtracted

Q23: Swansea Finishing produces and sells a decorative

Q24: Absorption costing is a method of inventory

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents