The Following Information Pertains to Stone Wall Corporation What Is the Difference Between Operating Incomes Under Absorption Costing

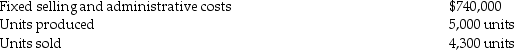

The following information pertains to Stone Wall Corporation:

What is the difference between operating incomes under absorption costing and variable costing?

A) $3,000

B) $37,000

C) $21,000

D) $10,500

Correct Answer:

Verified

Q46: Venus Corporation incurred fixed manufacturing costs of

Q47: Which of the following statements is true?

A)

Q48: Venus Corporation incurred fixed manufacturing costs of

Q49: Freetown Corporation incurred fixed manufacturing costs of

Q50: Jupiter Corporation incurred fixed manufacturing costs

Q51: In general, if inventory increases during an

Q52: Jupiter Corporation incurred fixed manufacturing costs

Q54: Freetown Corporation incurred fixed manufacturing costs of

Q55: Freetown Corporation incurred fixed manufacturing costs of

Q60: Which of the following statements is true

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents