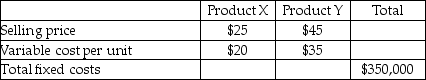

Atlanta Radio Supply sells only two products,Product X and Product Y.

Atlanta Radio Supply sells three units of Product X for each two units it sells of Product Y.Atlanta Radio Supply has a tax rate of 25%.

Required:

a.What is the breakeven point in units for each product,assuming the sales mix is 3 units of Product X for each two units of Product Y?

b.How many units of each product would be sold if Atlanta Radio Supply desired an after-tax net income of $210,000,using its tax rate of 25%?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q185: Gross Margin will always be greater than

Q187: In the merchandising sector _.

A) only variable

Q188: What is sales mix? How do companies

Q193: Stella Company sells only two products,Product

Q194: While-You-Train is a not-for-profit organization that aids

Q197: Fine Suiting Company sells shirts for men

Q199: To apply CVP analysis in a not-for

Q200: Contribution margin and gross margin are terms

Q200: Craylon Manufacturing Company produces two products,X and

Q201: When there are multiple cost drivers the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents