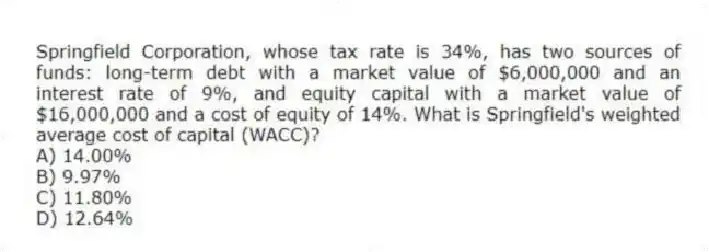

Springfield Corporation, whose tax rate is 34%, has two sources of funds: long-term debt with a market value of $6,000,000 and an interest rate of 9%, and equity capital with a market value of $16,000,000 and a cost of equity of 14%. What is Springfield's weighted average cost of capital (WACC) ?

A) 14.00%

B) 9.97%

C) 11.80%

D) 12.64%

Correct Answer:

Verified

Q36: The top management at Amore Corp, a

Q37: Bouvous Corporation had the following information for

Q38: The top management at Groundsource Company, a

Q39: Zenith Corporation's net income is $80,000. What

Q40: Coldbrook Company has two sources of funds:

Q42: Springfield Corporation, whose tax rate is 30%,

Q43: Care Inc., has two divisions that operate

Q44: Times Corporation, whose tax rate is 30%,

Q45: Waldorf Company has two sources of funds:

Q46: A company which favors the residual income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents