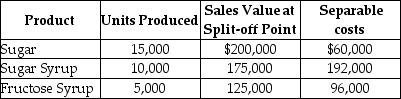

Berkel Company processes sugar cane into three products.During May,the joint costs of processing were $600,000.Production and sales value information for the month were as follows:

Required:

Determine the amount of joint cost allocated to each product if the sales value at split-off method is used.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q98: In joint costing, the physical measures are

Q101: Calamata Corporation processes a single material into

Q102: Oregon Lumber processes timber into four products.During

Q104: Which of the following statements is true

Q106: The constant gross-margin percentage NRV method is

Q111: When the selling prices of all products

Q113: Under the benefits-received criterion, the physical-measure method

Q115: For each of the following methods of

Q116: Which of the following is not true

Q117: In joint costing, which method assumes that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents