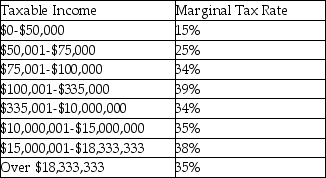

2013 U.S.Corporate tax rates are shown below:

Bouffard Co.has earnings before taxes of $100,000,000 in 2013.The company's tax expense will be

A) $3,500,000

B) $36,500,000

C) $31,875,000

D) $35,000,000

Correct Answer:

Verified

Q21: Corporate income statements are usually compiled on

Q34: Based on the information contained in Table

Q35: Generally Accepted Accounting Principles (GAAP) require companies

Q37: Based on the information contained in Table

Q38: Based on the information contained in Table

Q39: The company's gross profit margin is EBIT

Q41: Which of the following would NOT be

Q42: Grass Gadgets had sales of $30 million

Q44: A & K Co.expects to have earnings

Q47: The marginal tax rate would equal the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents