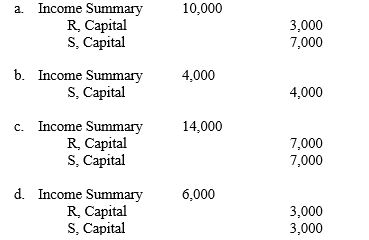

Partners R and S receive a salary allowance of $3,000 and $7,000, respectively, and share the remainder equally. If the company earned $4,000 during the period, the entry to close the income or loss into their capital accounts is:

Correct Answer:

Verified

Q62: Which of the following does not result

Q64: When a partner invests assets other than

Q67: Claim to the partners' personal assets by

Q68: Which of the following partnership characteristics is

Q73: A partnership agreement should include

A) the method

Q74: Gains and losses on the sale of

Q74: The ability of a partner to enter

Q76: Which of the following partnership characteristics is

Q80: Noncash assets invested into a partnership are

Q120: In a limited partnership

A)the general partners have

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents