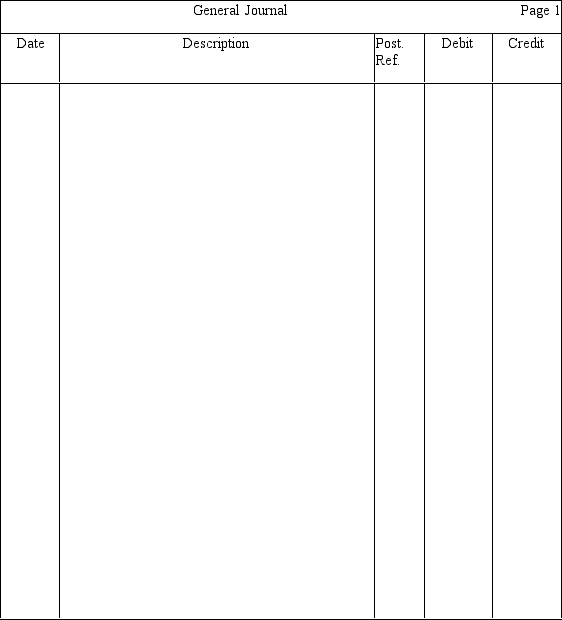

Elise, Farrah, and Gina are liquidating their business. They share income and losses in a 2:3:1 ratio, respectively, and currently have capital balances of $30,000, $21,000, and $39,000, respectively. In addition, the partnership has $15,000 in cash, $25,000 in accounts payable, and $100,000 in noncash assets. Elise and Gina are personally solvent, but Farrah is not. Assuming that the noncash assets are sold for $46,000, prepare all liquidation entries in the journal provided. (Omit explanations.)

Correct Answer:

Verified

Q120: Avery and Bert are partners who share

Q121: Bjorn and Canute are partners who

Q123: Tracy and Dennis are partners in

Q125: Aaron, Ben, and Carl are liquidating their

Q126: Tom, Dick, and Harry each receive a

Q127: Fred and Walden are partners who

Q128: Jimmy, Karol, and Lui are partners in

Q129: Percy, Quinn, and Renee each receive a

Q130: Describe how a dissolution of a partnership

Q139: Warren and Spencer are partners in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents