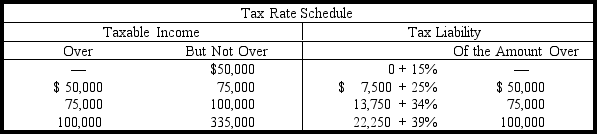

Kappa Corporation had a taxable income of $69,000 for 2010. Calculate the income taxes expense of Kappa Corporation on the basis of the following tax schedule:

Correct Answer:

Verified

Q152: What is the basis of the statement

Q153: Distinguish between cash and retained earnings.

Q154: How is it possible for a company

Q155: Ricardo Corporation reported earnings per share of

Q156: Define the term quality of earnings, and

Q158: Elias Corporation has 40,000 shares of $10

Q159: What issues must be considered when determining

Q160: What are potentially dilutive securities, and how

Q161: a. Shoup Corporation has 9,000 shares of

Q162: The following facts pertain to the stockholders'

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents