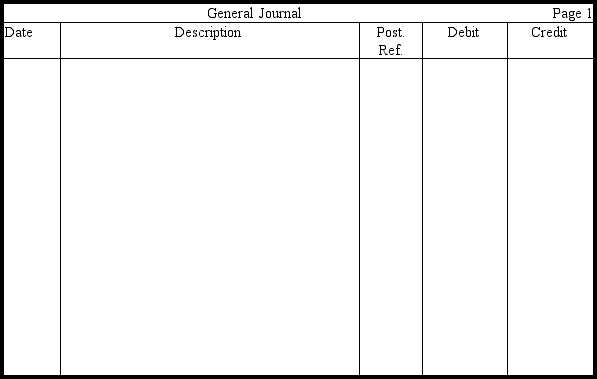

On January 1, 2010, Lurline Corporation issued ten-year, 8 percent bonds with a face value of $500,000. The semiannual interest dates are June 30 and December 31. The bonds were issued for $437,740 875,480 to yield an effective annual rate of 10 percent. The accounting year ends on December 31. Prepare entries in journal form without explanations to record the bond issue on January 1, 2010, and the payments of interest and amortization of discount on June 30 and December 31, 2010. Use the effective interest method of amortization. Round answers to the nearest dollar.

Correct Answer:

Verified

Q166: Fiona Corporation has a 7 percent, $600,000

Q167: On November 1, 2009, Fields Corporation issued

Q169: Boris Corporation had income before income taxes

Q172: West Valley Corporation issues $800,000 of 20-year,9

Q172: On July 1, 2010, Aloha Corporation issued

Q174: On January 2, 2010, Horst Corporation issued

Q182: Comment on the change in both the

Q184: When fixed mortgage payments are made,in what

Q191: When determining the value of a bond

Q194: When a bond sells at a discount,what

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents