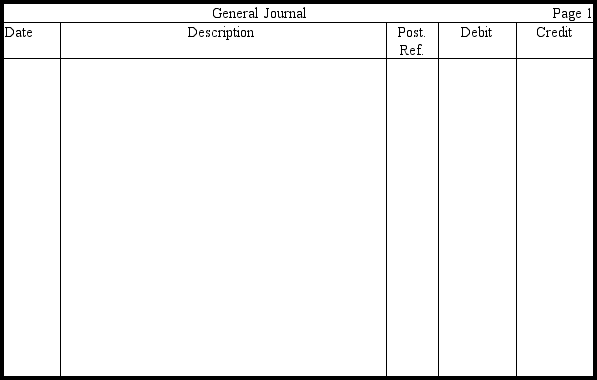

Tatum Corporation has $2,000,000 worth of 7 percent convertible bonds outstanding. On September 1, 2010,there is $80,000 of unamortized discount associated with these bonds. The bonds are convertible at the rate of 30 shares of $10 par value common stock for each $1,000 bond. On September 1, 2010,an interest payment date, bondholders presented $1,400,000 of the bonds for conversion. Prepare an entry in journal form without explanation to record the conversion of the bonds.

Correct Answer:

Verified

Q161: The amount of cash received on issuance

Q175: Flint Corporation issues $1,000,000 of 30-year,8 percent

Q176: A corporation issues bonds that pay interest

Q182: Strathern Corporation issued ten-year term bonds dated

Q184: On July 1, 2010,Benchley Corporation issued bonds

Q185: A notice appeared in the Grant Street

Q186: Valdez Corporation has outstanding $1,500,000 of 10

Q188: When bonds are converted to common stock,what

Q190: Technically,what is meant by the amortization of

Q197: Comment on the change in both the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents