In its 2010 annual report, Gamma Company indicated that the number of common shares held in the treasury decreased from 45,546,171 in 2009 to 3,397,381 in 2010. The following also was reported:

By Board authorization, effective December 31, 2010 the Company cancelled 50 million shares of common stock held in treasury. As a result of the cancellation, common stock decreased by $125 million, capital in excess of par value of stock decreased by $228 million, and retained earnings decreased by $3,119 million.

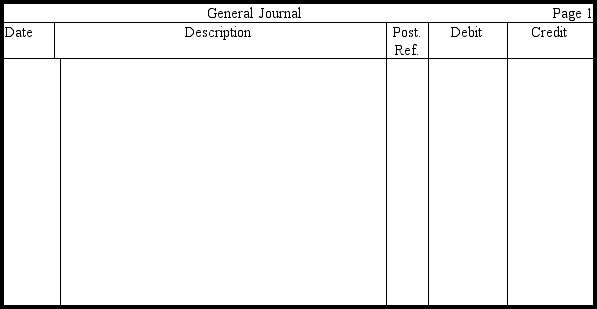

The shares cancelled or retired represent almost 25 percent of the shares of common stock issued by Gamma. Explain the accounting for the treasury shares by Gamma. Did the company buy any treasury shares during the year? Prepare the entry in journal form that was made to record the cancellation or retirement of the treasury shares. At what average price were the treasury shares purchased, and at what average price were they originally issued? What do you think was management's reason for purchasing the treasury shares? (Omit explanations.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q159: Use the following information to answer the

Q160: Use the following information to obtain the

Q161: On its December 31, 2009, balance sheet,

Q162: Brandt Corporation is authorized to issue 100,000

Q164: Stonehurst Corporation is authorized to issue 100,000

Q165: Prepare the entries in journal form necessary

Q166: Prepare in proper form the stockholders' equity

Q168: Paloma Corporation had 5,000 shares of $100

Q183: Why must a corporation have sufficient retained

Q232: People's Electric Company omitted all its preferred

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents