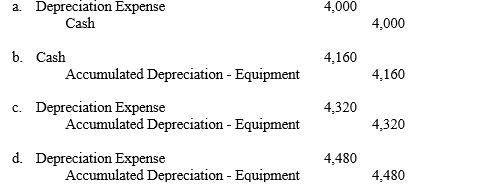

Lester Company purchases a piece of equipment on Jan. 2, 2010, for $30,000. The equipment has an estimated life of eight years or 50,000 units of production and an estimated residual value of $3,000. Lester uses a calendar fiscal year. The entry to record the amount of depreciation for 2010, using the production method and assuming that 8,000 units are produced, is

Correct Answer:

Verified

Q121: Equipment was purchased for $78,000.It had an

Q129: Which of the following would not be

Q134: All of the following are possible reasons

Q141: When calculating a partial year's depreciation,the length

Q143: Equipment is purchased for $80,000. It has

Q143: An asset was purchased for $200,000.It had

Q146: A graph depicting yearly depreciation expense under

Q147: Accelerated depreciation assumes all of the following

Q147: A truck is purchased for $35,000. It

Q157: A building was purchased for $500,000.It has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents