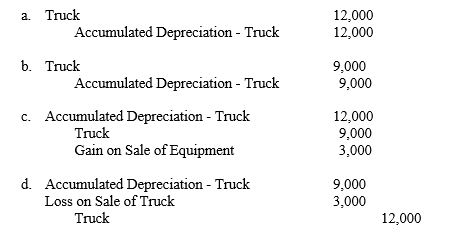

A truck that cost $12,000 and on which $9,000 of accumulated depreciation has been recorded was disposed of on January 1. If the truck was discarded as having no value, the entry to record this event is

Correct Answer:

Verified

Q161: A specialized piece of equipment closely associated

Q163: When an asset is sold,a gain is

Q174: A truck that cost $12,000 and on

Q174: Which of the following statements is true

Q176: Kotter Mining Company purchases a gravel pit

Q177: The depletion calculation is similar to which

Q178: Equipment costing $30,000 with a residual value

Q182: According to generally accepted accounting principles, the

Q190: When an intangible asset becomes worthless,

A)it should

Q196: The federal government grants patents for

A)10 years.

B)20

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents