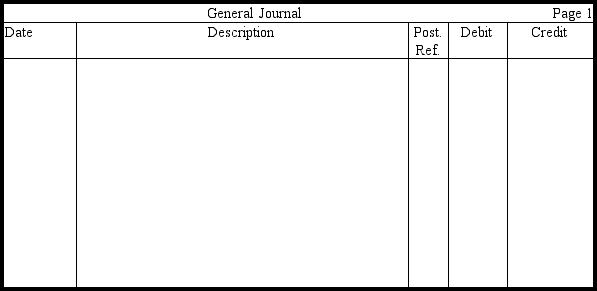

Darla Katz earns an hourly wage of $12, with time-and-a-half pay for hours worked over 40 per week. During the most recent week, she worked 46 hours, her federal tax withholding totaled $62, her state tax withholding totaled $18, and $3 was withheld for union dues. Assuming a 6.2 percent social security tax rate and a 1.45 percent Medicare tax rate, prepare the entry without explanations in the journal provided to record Katz's wages and related liabilities. Round to the nearest penny.

Correct Answer:

Verified

Q163: Under what circumstances is a contingent liability

Q164: You win the grand prize and can

Q170: Explain why the cost of employing someone

Q170: State whether each situation below implies a

Q171: Packett Company allows each employee two weeks'

Q172: Calculate answers to the following questions using

Q178: Dougan Company manufactures and sells widgets. Each

Q179: Jim Janney is paid $6 per hour,

Q190: Hatley Corporation borrowed $10 million to finance

Q191: Calculate answers to the following questions using

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents