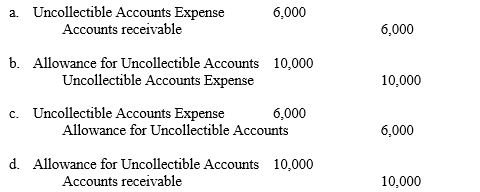

Cottage Sales Company made most of its sales on credit during its first year of operation, 2010. At the end of the year, accounts receivable amounted to $100,000. On December 31, 2010, management reviewed the collectible status of the accounts receivable. Approximately $6,000 of the $100,000 of accounts receivable were estimated to be uncollectible. As per the accounts receivable aging method the adjusting entry that would be made on December 31 of that year is:

Correct Answer:

Verified

Q87: What is a contingent liability,and how does

Q100: What purpose is served by a factoring

Q130: Why do businesses need to keep some

Q141: What is a compensating balance? By whom

Q150: Use the following T account to

Q152: For each of the items below,

Q153: Sally's Dress Shop has $5,800 in Accounts

Q156: Assume that on January 15, a

Q157: The following data exist for Conner

Q158: Compute the correct amount for each

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents