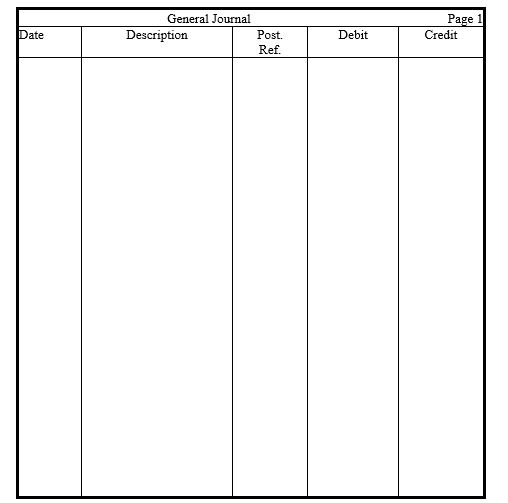

Prepare year-end adjusting entries for each of the following situations:

a. The Store Supplies account showed a beginning debit balance of $400 and purchases of $2,800. The ending debit balance was $800.

b. Depreciation on buildings is estimated to be $7,300.

c. A one-year insurance policy was purchased for $2,400. Nine months have passed since the purchase.

d. Accrued interest on notes payable amounted to $200.

e. The company received a $9,600 advance payment during the year on services to be performed. By the end of the year, one-third of the services had been performed.

f. Payroll for the five-day workweek, to be paid on Friday, is $10,000. The last day of the period is a Tuesday.

g. Services totaling $920 had been performed but not yet billed or recorded.

Correct Answer:

Verified

Q161: Answer the following questions. (Show your work.)

a.

Q162: Answer the following questions.(Show your work. )

a.Revenue

Q162: The income statement for Catlett Company

Q163: The following amounts are taken from the

Q164: In the journal provided, prepare year-end adjustments

Q167: Use the following unadjusted trial balance to

Q168: Given the adjusted trial balance below, prepare

Q169: In the journal provided, prepare year-end adjustments

Q170: Use the following unadjusted trial balance to

Q171: Prepare year-end adjusting entries for each of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents