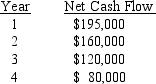

Heedy Inc.is considering a capital investment proposal that costs $460,000 and has an estimated life of four years and no residual value.The estimated net cash flows are as follows:

The minimum desired rate of return for net present value analysis is 10%.The present value of $1 at compound interest rates of 10% for 1,2,3,and 4 years is .909,.826,.751,and .683,respectively.Determine the net present value.

Correct Answer:

Verified

Q64: The management of Wyoming Corporation is considering

Q65: The net present value for this investment

Q80: The expected average rate of return for

Q81: All of the following are factors that

Q82: All of the following qualitative considerations may

Q84: In capital rationing,alternative proposals that survive initial

Q85: Mars Corp.is choosing between two different capital

Q87: The net present value has been computed

Q88: Sommers Company is evaluating a project requiring

Q99: One issue to consider when investing in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents