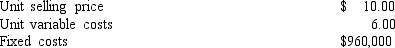

Vest Food Co.has the following operating data:

The company is contemplating moving to another state where direct labor costs can be reduced,thereby reducing the unit variable cost by 10%.The state where the company currently operates has offered to reduce property taxes to encourage Vest to stay.The minimum amount of property tax savings necessary to keep the company,assuming no other changes,would be

A) $152,016.

B) $240,000.

C) $208,696.

D) $125,217.

Correct Answer:

Verified

Q102: Kennedy Co.sells two products,Arks and Bins.Last year,Kennedy

Q104: If fixed costs are $561,000 and the

Q104: If variable costs per unit increased because

Q105: Kennedy Co.sells two products,Arks and Bins.Last year,Kennedy

Q108: Assuming that last year's fixed costs totaled

Q108: Clinton Co.has an operating leverage of 4.Sales

Q112: Rouney Co.has budgeted salary increases to factory

Q121: The point where the sales line and

Q136: Which of the following conditions would cause

Q139: The point where the profit line intersects

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents