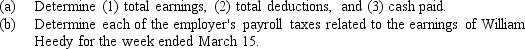

The following information is for employee William Heedy for the week ended March 15.

Total hours worked: 48

Rate: $16 per hour,with double time for all hours in excess of 40

Federal income tax withheld: $200

United Fund deduction: $50

Cumulative earnings prior to current week: $6,400

Tax rates:

Social security: 6% on maximum earnings of $106,800

Medicare tax: 1.5% on all earnings;on both employer and employee

State unemployment: 3.4% on maximum earnings of $7,000;on employer

Federal unemployment: 0.8% on maximum earnings of $7,000;on employer

Correct Answer:

Verified

Q76: For the year that just ended, a

Q105: A company sold 200 shares of common

Q114: Significant changes in stockholders' equity are reported

Q121: The summary of the payroll for the

Q122: Based on the following information,what is earnings

Q123: A corporation has the following stockholders' equity

Q125: Illustrate the effects on the accounts and

Q127: The following accounts and their balances appear

Q128: Smith Co.is considering the following alternative plans

Q129: A corporation,which had 20,000 shares of common

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents