Fred and Barney started a partnership.During Year 1,Fred invested $20,000 in the business and Barney invested $32,000.The partnership agreement called for each partner to receive an annual distribution equal to 15% of his capital contribution.Any further earnings were to be retained in the business and divided equally between the partners.The partnership reported net income of $38,000 during Year 1.How will the $38,000 of net income be split between Fred and Barney respectively? (Hint: Consider both the cash withdrawals and allocation of remaining income. )

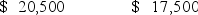

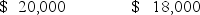

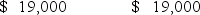

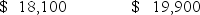

Fred Barney

A)

B)

C)

D)

Correct Answer:

Verified

Q2: Which of the following entities would report

Q3: Which of the following best describes how

Q4: On January 2,Year 1,Torres Corporation issued 20,000

Q5: Ogilvie Corp.issued 12,000 shares of no-par stock

Q6: Fixit Corporation issued 20,000 shares of $20

Q8: Which of the following is not normally

Q9: Which of the following statements best describes

Q10: Which of the following is a disadvantage

Q11: Which form of business organization is established

Q12: Which of the following entities would have

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents