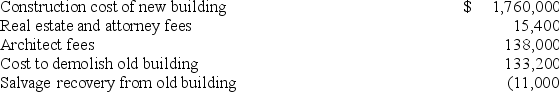

On January 6,Year 1,Mount Jackson Corporation purchased a tract of land for a factory site for $1,500,000.An existing building on the site was demolished and the new factory was completed on October 11,Year 1.Additional cost data are shown below:

Which of the following are the capitalized costs of the land and the new building,respectively?

A) $1,637,600 and $1,898,000

B) $1,515,400 and $2,020,200

C) $1,648,600 and $1,887,000

D) $1,500,000 and $2,035,600

Correct Answer:

Verified

Q5: Which of the following intangible assets does

Q6: Which method of depreciation is used by

Q7: Laramie Co.paid $800,000 for a purchase that

Q8: Flagler Company purchased equipment that cost $90,000.The

Q9: On January 1,Year 1 Missouri Co.purchased a

Q11: On March 1,Bartholomew Company purchased a new

Q12: Anchor Company purchased a manufacturing machine with

Q13: Which of the following would not be

Q14: Which of the following would not be

Q15: Chico Company paid $950,000 for a basket

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents