Manhattan Company recorded an adjusting entry to accrue interest owed of $300 as of December 31,Year 1.When the related note was paid during Year 2,the company paid $450 in interest.Which of the following journal entries correctly records this Year 2 transaction? (Assume that the entry to record the payment of the note itself was recorded in a separate journal entry. )

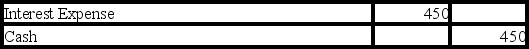

A)

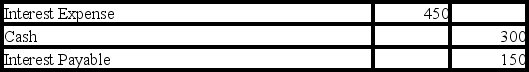

B)

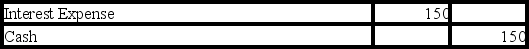

C)

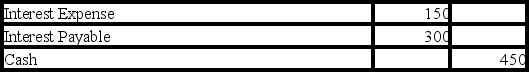

D)

Correct Answer:

Verified

Q96: On August 1,Year 1,Bellisa Company issued a

Q97: The adjusting entry to record expense related

Q98: An adjusting entry can never be an

Q99: Calculating the debt-to-assets ratio measures how efficiently

Q100: A trial balance can be in balance,even

Q101: Callahan Corporation recorded an adjusting entry using

Q102: Which of the following statements about the

Q103: A $200 credit to Interest Payable was

Q104: Vargas Company purchased a computer for $3,000

Q106: A transaction has been recorded in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents