The City of Warwick received $4,000,000 from one of its most prominent citizens during the year ended June 30,20X9.The donor stipulated that the $4,000,000 be invested permanently,and that interest and dividends earned on the investments be used to support the homeless people of Warwick.During the year ended June 30,20X9,dividends received from stock investments amounted to $20,000,while interest received from bond investments amounted to $40,000.At June 30,20X9,$10,000 of interest was earned,but it will not be received until July of 20X9.The fair value of the securities in which the $4,000,000 was invested had increased $8,000 by June 30,20X9.

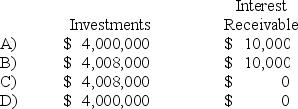

-Refer to the above information.On the statement of fiduciary net assets at June 30,20X9,the nonexpendable trust fund should report investments and interest receivable of:

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q49: An internal service fund had the following

Q50: Carlisle established a motor vehicle service and

Q51: An internal service fund had the following

Q52: A tax collection fund that collects property

Q53: Which of the following financial statements would

Q55: A citizen of York purchased a truck

Q56: Riviera Township reported the following data for

Q57: On the statement of cash flows prepared

Q58: Enterprise and internal service funds should recognize

Q59: Which of the following fiduciary funds does

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents