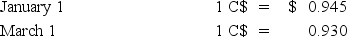

Myway Company sold equipment to a Canadian company for 100,000 Canadian dollars (C$) on January 1,20X9 with settlement to be in 60 days.On the same date,Myway entered into a 60-day forward contract to sell 100,000 Canadian dollars at a forward rate of 1 C$ = $.94 in order to manage its exposed foreign currency receivable.The forward contract is not designated as a hedge.The spot rates were:

-Based on the preceding information,had Myway not used the forward exchange contract,net income for the year would have:

A) increased by $1,000.

B) increased by $500.

C) decreased by $1,000.

D) decreased by $1,500.

Correct Answer:

Verified

Q30: Levin company entered into a forward contract

Q31: Spartan Company purchased interior decoration material from

Q32: Robert Company sold inventory to an Australian

Q33: On December 5,20X8,Texas based Imperial Corporation purchased

Q34: Robert Company sold inventory to an Australian

Q36: Taste Bits Inc.purchased chocolates from Switzerland for

Q37: Spartan Company purchased interior decoration material from

Q38: Taste Bits Inc.purchased chocolates from Switzerland for

Q39: Company X denominated a December 1,20X9,purchase of

Q40: Tinitoys,Inc. ,a domestic company,purchased inventory from a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents