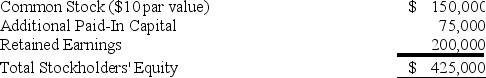

Peacoat Corporation acquired 80 percent of Sweater Corporation's common stock on March 31,20X4 for $360,000.At that date,the fair value of the noncontrolling interest was $90,000.On January 1,20X4,Sweater reported the following stockholders' equity balances:

Sweater reported net income of $100,000 in 20X4,earned uniformly throughout the year,and declared and paid dividends of $40,000 on December 31,20X4.Peacoat reported retained earnings of $500,000 on January 1,20X8,and had 20X4 income of $200,000 from its separate operations.Peacoat paid dividends of $50,000 on December 31,20X4.Peacoat accounts for its investment in Sweater Corporation using the fully adjusted equity method.

Sweater reported net income of $100,000 in 20X4,earned uniformly throughout the year,and declared and paid dividends of $40,000 on December 31,20X4.Peacoat reported retained earnings of $500,000 on January 1,20X8,and had 20X4 income of $200,000 from its separate operations.Peacoat paid dividends of $50,000 on December 31,20X4.Peacoat accounts for its investment in Sweater Corporation using the fully adjusted equity method.

-Based on the information provided,what is the consolidated income to the controlling interest reported for the year 20X4?

A) $275,000

B) $280,000

C) $260,000

D) $200,000

Correct Answer:

Verified

Q35: Pony Corporation acquired 90 percent of Saddle

Q36: Pony Corporation acquired 90 percent of Saddle

Q37: On July 1,20X8,Pair Logic Corporation acquires 75

Q38: Ponte Corporation owns 25 percent of the

Q39: On January 1,20X8,Putter Corporation acquired 40 percent

Q41: Plush Corporation holds 80 percent of Scratch

Q42: Pappas Company owns 85 percent of Sunny

Q43: Power Corporation owns 75 percent of Transmitter

Q44: Pappas Company owns 85 percent of Sunny

Q45: Company P holds 70 percent of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents