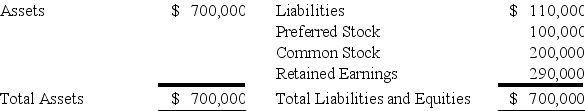

Protective Corporation acquired 70 percent of the common shares and 60 percent of the preferred shares of Safety Corporation at underlying book value on January 1,20X6.At that date,the fair value of the noncontrolling interest in Safety's common stock was equal to 30 percent of the book value of its common stock.Safety's balance sheet at the time of acquisition contained the following balances:

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.

-Based on the preceding information,what is Safety's contribution to consolidated net income for 20X6?

A) $48,000

B) $56,000

C) $72,000

D) $80,000

Correct Answer:

Verified

Q11: On January 1,20X9,Princeton Company acquired 80 percent

Q12: Pail Corporation acquired 80 percent of the

Q13: Pail Corporation acquired 80 percent of the

Q14: Pooley Corporation owns 75 percent of the

Q15: Pail Corporation acquired 80 percent of the

Q17: Protective Corporation acquired 70 percent of the

Q18: Protective Corporation acquired 70 percent of the

Q19: Protective Corporation acquired 70 percent of the

Q20: On January 1,20X9,Princeton Company acquired 80 percent

Q21: On January 1,20X7,Pisa Company acquired 80 percent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents