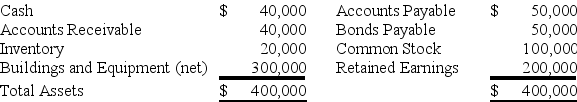

Plate Corporation acquired 75 percent of the stock of Silver Company on January 1,20X7,for $225,000.At that date,the fair value of the noncontrolling interest was $75,000.Silver's balance sheet contained the following amounts at the time of the combination:

During each of the next three years,Silver reported net income of $30,000 and paid dividends of $10,000.On January 1,20X9,Plate sold 1,500 shares of Silver's $10 par value shares for $60,000 in cash.Plate used the fully adjusted equity method in accounting for its ownership of Silver Company.

During each of the next three years,Silver reported net income of $30,000 and paid dividends of $10,000.On January 1,20X9,Plate sold 1,500 shares of Silver's $10 par value shares for $60,000 in cash.Plate used the fully adjusted equity method in accounting for its ownership of Silver Company.

-Based on the preceding information,in the consolidating entries to complete a full consolidation worksheet,Investment in Silver Stock at January 1,20X9,will be credited for:

A) $255,000.

B) $240,000.

C) $204,000.

D) $136,000.

Correct Answer:

Verified

Q31: Play Company acquired 70 percent of Screen

Q32: Petunia Corporation acquired 90 percent of the

Q33: Plate Corporation acquired 75 percent of the

Q34: Play Company acquired 70 percent of Screen

Q35: Patty Corporation holds 75 percent of Slider

Q37: Petunia Corporation acquired 90 percent of the

Q38: Petunia Corporation acquired 90 percent of the

Q39: Perfect Corporation acquired 70 percent of Storm

Q40: Perfect Corporation acquired 70 percent of Storm

Q41: X Corporation owns 80 percent of Y

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents