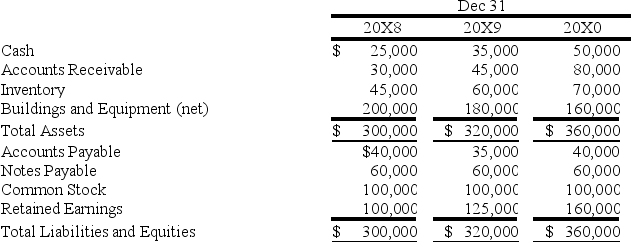

Perfect Corporation acquired 70 percent of Storm Company's shares on December 31,20X8,for $140,000.At that date,the fair value of the noncontrolling interest was $60,000.On January 1,20X0,Perfect acquired an additional 10 percent of Storm's common stock for $32,500.Summarized balance sheets for Storm on the dates indicated are as follows:

Storm paid dividends of $10,000 in each of the three years.Perfect uses the fully adjusted equity method in accounting for its investment in Storm and amortizes all differentials over 5 years against the related investment income.All differentials are assigned to patents in the consolidated financial statements.

Storm paid dividends of $10,000 in each of the three years.Perfect uses the fully adjusted equity method in accounting for its investment in Storm and amortizes all differentials over 5 years against the related investment income.All differentials are assigned to patents in the consolidated financial statements.

-Based on the preceding information,Storm Company's net income for 20X9 and 20X0 are:

A) $10,000 and $20,000 respectively.

B) $25,000 and $35,000 respectively.

C) $35,000 and $45,000 respectively.

D) $25,000 and $45,000 respectively.

Correct Answer:

Verified

Q18: Protective Corporation acquired 70 percent of the

Q19: Protective Corporation acquired 70 percent of the

Q20: On January 1,20X9,Princeton Company acquired 80 percent

Q21: On January 1,20X7,Pisa Company acquired 80 percent

Q22: Patty Corporation holds 75 percent of Slider

Q24: Plate Corporation acquired 75 percent of the

Q25: Petunia Corporation acquired 90 percent of the

Q26: Plate Corporation acquired 75 percent of the

Q27: Plate Corporation acquired 75 percent of the

Q28: Play Company acquired 70 percent of Screen

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents