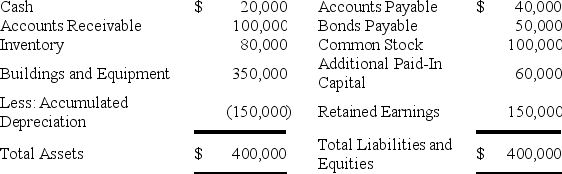

Pratt Corporation acquired 90 percent of Splatt Corporation's common shares on January 1,20X6,at underlying book value.At that date,the fair value of the noncontrolling interest was equal to 10 percent of the book value of Splatt.Splatt Corporation prepared the following balance sheet as of January 1,20X9:

The company is considering the following alternatives:

1.A 3-for-1 stock split

2.A stock dividend of 7,000 shares on its $5 par value common stock

3.A stock dividend of 2,000 shares on its $5 par value common stock

The current market price per share of Splatt stock on January 1,20X9,is $15.

Required:

Give the investment elimination entry required to prepare a consolidated balance sheet at the close of business on January 1,20X9,for each of the alternative transactions under consideration by Splatt Corporation.

Correct Answer:

Verified

Book Value Calc...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: On January 1,20X9,A Company acquired 85 percent

Q47: X Corporation owns 80 percent of Y

Q48: On January 1,20X9,A Company acquired 85 percent

Q49: On January 1,20X7,Pisa Company acquired 80 percent

Q50: On January 1,20X7,Pisa Company acquired 80 percent

Q52: Plum Corporation acquired 80 percent of Saucy

Q53: On January 1,20X7,Pisa Company acquired 80 percent

Q54: Pratt Corporation owns 75 percent of Swan

Q55: On January 1,20X9,A Company acquired 85 percent

Q56: X Corporation owns 80 percent of Y

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents