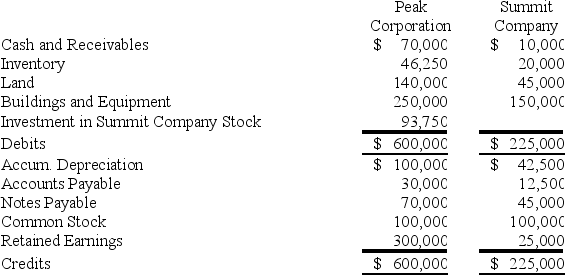

Peak Corporation owns 75 percent of Summit Company's voting shares,acquired on March 21,20X5,at book value.At that date,the fair value of the noncontrolling interest was equal to 25 percent of the book value of Summit Company.

On January 1,20X4,Peak paid $150,000 for equipment with a 10-year expected total economic life.The equipment was depreciated on a straight-line basis with no residual value.Summit purchased the equipment from Peak on December 31,20X6,for $140,000.Summit sold land it had purchased for $75,000 on February 18,20X4,to Peak for $60,000 on October 10,20X7.

Required:

Prepare the consolidation entries for 20X8 related to the sale of depreciable assets and land if Peak uses the fully adjusted equity method to account for its investment in Summit.

Correct Answer:

Verified

Eliminate the gain on bui...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q39: Pat Corporation acquired 80 percent of Smack

Q40: Plesco Corporation acquired 80 percent of Slesco

Q41: Pie Company acquired 75 percent of Strawberry

Q42: On January 1,20X7,Server Company purchased a machine

Q43: On January 1,20X7,Server Company purchased a machine

Q45: On January 1,20X7,Server Company purchased a machine

Q46: Pint Corporation holds 70 percent of Size

Q47: Plesco Corporation acquired 80 percent of Slesco

Q48: Pint Corporation holds 70 percent of Size

Q49: Pint Corporation holds 70 percent of Size

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents