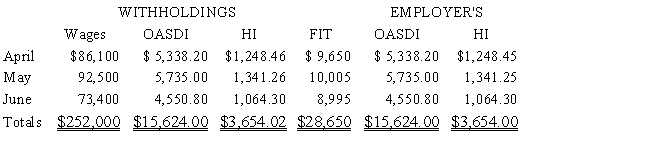

Lidge Company of Texas (TX)is classified as a monthly depositor and pays its employees monthly.The following payroll information is for the second quarter of 20--.

The number of employees on June 12,20-- was 11.

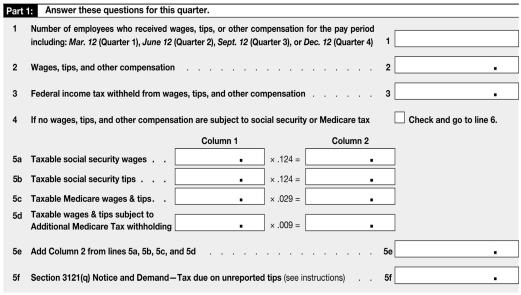

a.Complete the following portion of Form 941.

Source: Internal Revenue Service

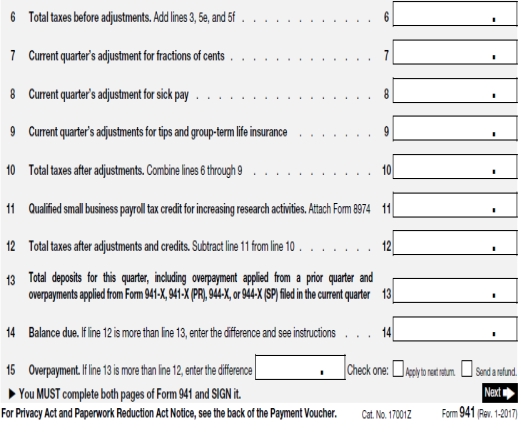

b.Complete the following portion of Form 941.

Source: Internal Revenue Service

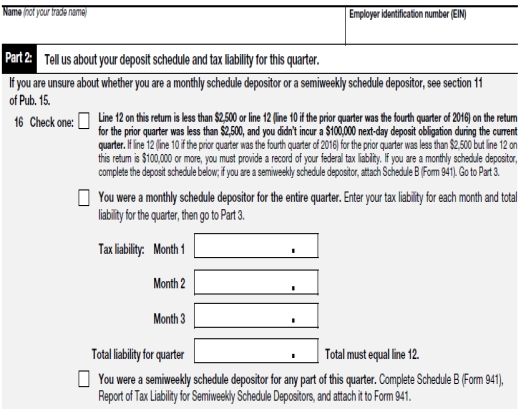

c.Complete Part 2 of Form 941.

Source: Internal Revenue Service

d.What are the payment due dates of each of the monthly liabilities assuming all

deposits were made on time,and the due date of the filing of Form 941 (year 20--)?

Correct Answer:

Verified

Source: Internal Revenue Servic...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: Refer to Instruction 3-1.In this pay,Moss

Q63: Refer to Instruction 3-1.Beginning with the first

Q64: Refer to Instruction 3-1.Crow earned $585.15 during

Q65: Refer to Instruction 3-1.Eager,a tipped employee,reported to

Q66: Refer to Instruction 3-1.Fess receives wages totaling

Q67: Refer to Instruction 3-1.Dee is paid $2,345

Q68: Refer to Instruction 3-1.On the last weekly

Q69: Refer to Instruction 3-1.During 20--,Garr was paid

Q70: Refer to Instruction 3-1.Jax Company's (a monthly

Q72: Refer to Instruction 3-1.Ralston is the sole

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents