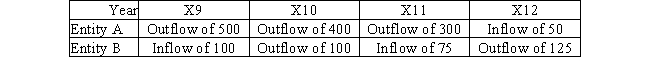

Two independent business entities A and B were created in X0.They are,today ,relatively similar in size and serve similar but separate markets.They report the following time series for their anticipated net cash flow from investing in both tangible and intangible investments (amounts expressed in CU) :

A) Entity B appears to be intent on growing faster than entity A.

B) Entity B appears to offer a lower risk to investors than entity A.

C) Entity A appears to be intent on growing faster than entity B.

D) Entity A demonstrates a better ability to reimburse its long-term debt than entity B.

Correct Answer:

Verified

Q6: IFRS GAAP requirement that a statement of

Q7: The primary impact of the timing difference

Q8: Generally,the operating cash flow is expected to

Q9: A retailer is paid cash by its

Q10: How is the available cash flow calculated?

A)

Q12: The way IFRS GAAP demand that financial

Q13: Of the 4 strategies described below,which one

Q14: The indirect method of calculation of the

Q15: What ratio is used to calculate 'cash

Q16: A business entity generates a cash flow

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents