On July 1,2019,Bobby's Building Corp.issued $1,000,000 of 11% bonds dated July 1,2019 for $1,062,771.The bonds were sold to yield 10% and pay interest semiannually on July 1 and January 1.Bobby's Building Corp.uses the effective interest method of amortization.The company's fiscal year ends on February 28.

Required:

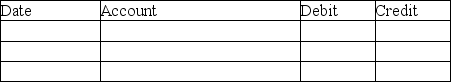

1.Prepare the journal entry on July 1,2019.

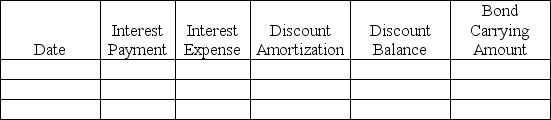

2.Prepare the amortization table for the first two interest periods.

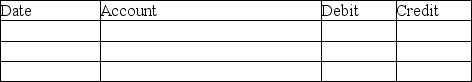

3.Prepare the journal entry on January 1,2020.

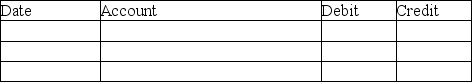

4.Prepare the adjusting entry needed on February 28,2020.

Round all amounts to the nearest dollar.Omit explanations for all journal entries.

1.

2.

2.

3.

3.

4.

4.

Correct Answer:

Verified

Q89: Which type of lease will NOT increase

Q90: Operating leases are preferred over finance leases

Q91: If convertible notes payable are converted into

Q92: For operating leases,the lessee obtains the risks

Q93: Because operating leases require the lessee to

Q95: A _ may allow the company leasing

Q96: Lease payments are paid by the lessor.

Q97: Godwin Corporation retires its bonds at 105

Q98: Immediately after the last interest payment,Henry Company

Q99: For tax reporting purposes,a company must follow

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents