On April 1st,Jones Corporation purchased $15,000 of inventory using a short-term note payable due in one year at 8% interest.Jones Corporation's fiscal year ends on December 31.

Required:

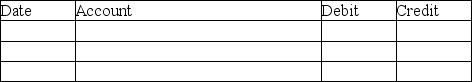

1.Journalize the purchase of the inventory.Omit explanation.

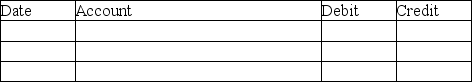

2.Journalize the accrued interest expense on December 31st.Omit explanation.

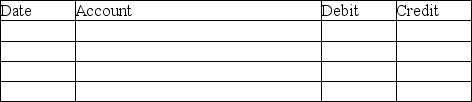

3.Journalize the payment of the note payable the following year on March 31st.Omit explanation.

1.

2.

2.

3.

3.

Correct Answer:

Verified

Q70: The balance of the Unearned Revenue account

Q71: FICA tax includes:

A)social security and medicare.

B)social security

Q72: Warranties and income taxes are examples of

Q73: Failure to record an accrued liability for

Q74: The accrual method of accounting requires that

Q76: The journal entry to accrue salaries earned

Q77: For a service organization,compensation is not generally

Q78: A wage is employee pay at a

Q79: Davies Accessories Company entered into the following

Q80: When a business receives cash from customers

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents