Auto Shop,Inc. ,incurred the following costs in acquiring plant assets:

a.Purchased land with a $100,000 down payment and signed a $75,000 note payable for the balance.

b.Delinquent property tax of $2,500 and legal fees of $1,000 had to be paid before the land could be purchased.

c.$12,000 was paid to demolish an unwanted building on the land.

d.Architect fee of $7,000 was paid for the design of a new office building.

e.An office building was constructed at a cost of $500,000.A long-term note payable was used to pay for the cost.

f.$17,500 was paid for fencing around the new building.$55,000 was paid for paving the parking lot by the new building.

g.$20,000 was paid for lights in the new parking lot.

h.$10,000 was paid for a sprinkler system for the bushes and grass.

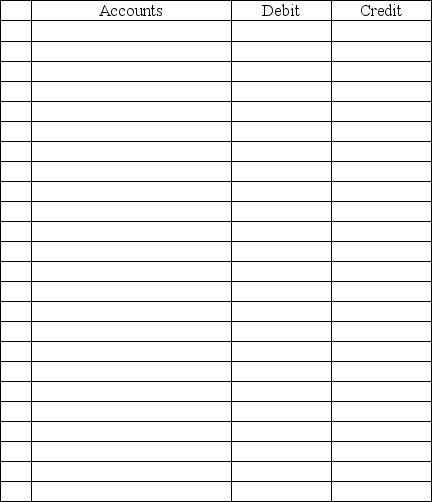

Required:

Prepare journal entries for the above transactions.Explanations are not required.

Correct Answer:

Verified

Q35: A machine is purchased for $80,000.The transportation

Q36: On June 1,Roadway's Trucking Company paid $9,000

Q37: On January 1,of the current year,Roadway Delivery

Q38: The distinction between a capital expenditure and

Q39: Treating a capital expenditure as an immediate

Q41: The Accumulated Depreciation account is an income

Q42: What is the distinction between a capital

Q43: The book value of an asset cannot

Q44: Book value of a plant asset equals

Q45: If a company capitalizes a cost that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents