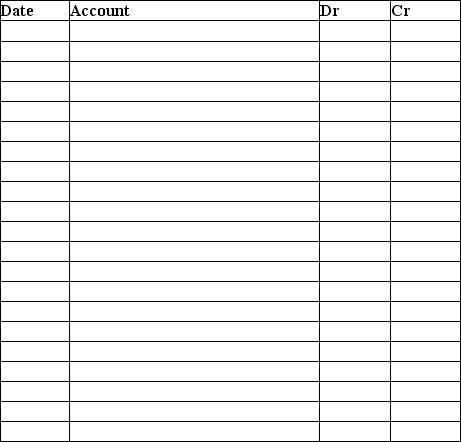

An auto dealer uses a perpetual inventory system.The dealer incurred the following transactions during the month of May:

1.On May 1,the dealer purchased 10 vehicles on account at $20,000 each,with credit terms of 2/10,net 30.

2.On May 2,the dealer returned one vehicle due to a product defect.

3.On May 3,the dealer sold 5 vehicles for $25,000 each on account.The credit terms are n/30.No sales returns are expected.

4.On May 9,the dealer paid for the vehicles purchased less the return on May 2.

5.On May 31,the dealer collected one-half of the amount due from the May 3 sale.

6.On May 31,the dealer paid the rent for the next month of $2,500.

Required:

Prepare the journal entries for the dealer during the month of May.Explanations are not required.

Correct Answer:

Verified

Q42: If a company uses LIFO for tax

Q43: When inventory costs are rising,FIFO allows managers

Q44: To determine the cost of ending inventory

Q45: If inventory costs are rising and a

Q46: Steve's Hardware Store uses the perpetual inventory

Q48: The average cost per unit is calculated

Q49: When inventory costs are rising,a company using

Q50: Under the average-cost inventory method,to determine the

Q51: The choice of an inventory costing method

Q52: The LIFO method assigns the most recent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents