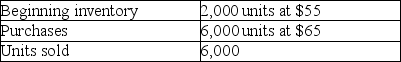

Using the following data,by how much would taxable income change if LIFO is used rather than FIFO?

A) There is no difference.

B) Increase by $20,000.

C) Decrease by $20,000.

D) Decrease by $60,000.

Correct Answer:

Verified

Q155: In 2019,ending inventory is overstated.What is the

Q156: Bayer Company uses the periodic inventory system.Bayer

Q157: Jaronski Company uses the periodic inventory system.At

Q158: In 2019,beginning inventory is overstated.What is the

Q159: Under the periodic inventory system:

A)the Inventory account

Q160: The journal entry to record the purchase

Q161: Carboni Company had the following data available

Q162: Using the following data,by how much would

Q164: The LIFO Reserve can increase only when:

A)inventory

Q165: The income tax saved by using LIFO

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents