Jones Corporation purchases $500,000 of Basic Corporation's stock on October 1,2020 at cost.Jones owns less than 2% of Basic's outstanding shares,and thus has insignificant influence.On December 1,2020 Jones Corporation received a cash dividend of $15,000 on the Basic Corporation's stock.On December 31,2020,Jones Corporation's investment in Basic Corporation has a fair value of $550,000.

Required:

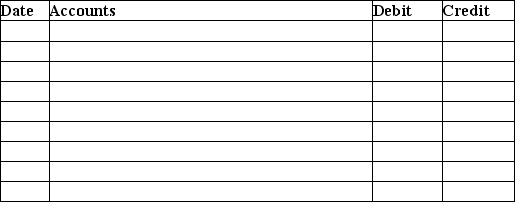

Prepare the necessary journal entries.Explanations are not required.

Correct Answer:

Verified

Q26: Investments accounted for by the equity method

Q27: A company that owns 40% of the

Q28: If an investor company owns 35% of

Q29: The fair value method of accounting for

Q30: An investor receives a cash dividend from

Q32: Wolverine Corporation owns 27% of Buckeye Corporation.Net

Q33: When an investor owns 35% of the

Q34: An investor who may significantly influence the

Q35: Under the equity method,the investor applies his

Q36: Cash dividends received on stock investments with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents