On January 1,2019,Walker Company pays $10 million for 40% of the voting stock of a supplier,Dorglass,Inc.On December 1,2019,Dorglass declared and paid cash dividends of $100,000.For the year ending December 31,2019,Dorglass also reported net income of $1,000,000.At December 31,2019,the fair value of 40% of Dorglass's stock was $9 million.On January 1,2020,all the Dorglass stock was sold for $9 million.

Required:

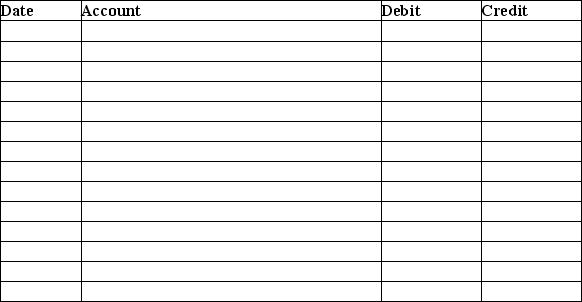

Prepare journal entries on the following dates:

1.January 1,2019

2.December 1,2019

3.December 31,2019

4.January 1,2020

Explanations are not required.

Correct Answer:

Verified

Q36: Cash dividends received on stock investments with

Q37: Under the equity method,the Equity-method Investment account

Q38: The equity method is used to account

Q39: Smith Corporation purchases $620,000 of TMI Corporation's

Q40: Under the equity method,when the investee reports

Q42: If the equity method is used to

Q43: The consolidation accounting method is appropriate when

Q44: On January 1 of the current year,Conner

Q45: An investor owns 32% of the outstanding

Q46: On January 1 of the current year,Gardner

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents