On January 1,2019,Exclusive Company purchases $10,000 of 6% bonds in Smiley Company at a price of 95.Exclusive Company intends to hold the bonds until the maturity date on January 1,2029,and has the ability to do so.The interest dates are January 1 and July 1.Exclusive Company amortizes any discount or premium using the straight-line method.The fiscal year end of Exclusive Company is December 31.

Required:

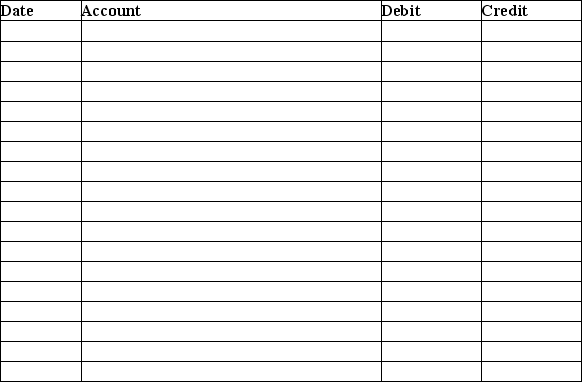

Prepare the journal entries on:

1.January 1,2019

2.July 1,2019

3.December 31,2019

4.January 1,2020

Explanations are not required.

Correct Answer:

Verified

Q73: The amortized cost method determines the carrying

Q74: A quoted bond price of 103 means

Q75: The face interest rate of a bond

Q76: On January 1,2019,Brooklyn Company purchases $82,000,8% bonds

Q77: Matthew Company purchases held-to-maturity bonds for $12,000

Q78: Debt investments that are expected to be

Q79: Consolidated financial statements:

A)are prepared if the parent

Q80: Both trading and available-for-sale investments in debt

Q82: On January 1,2019,Carmody Corporation purchased 6% bonds

Q83: Held-to-maturity investments in bonds are initially reported

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents