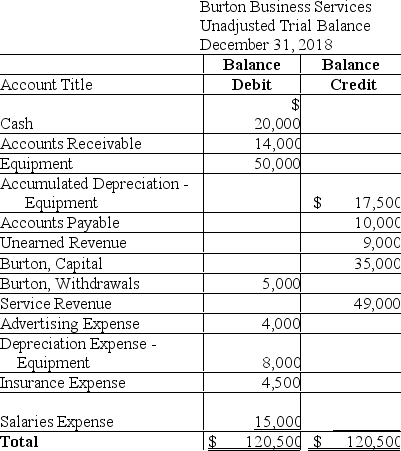

The unadjusted trial balance of Burton Business Services at December 31,2018,and the data for the adjustments follow:

Adjustment data at December 31 follows:

Adjustment data at December 31 follows:

a.Depreciation for the equipment is $4,000.

b.As of December 31,2018,Burton had performed services for Wilson Company for $3,000.The invoice will be sent on January 5,2019 and payment is due on January 15,2019.

c.On August 31,2018,Burton agreed to provide consulting services to Allen Company for 6 months,beginning on September 1,2018,at $1,500 per month.Allen paid $9,000 on August 31,2018.Burton treats deferred revenues initially as liabilities.

Burton is preparing financial statements for the year ending December 31,2018.

Requirements

1.Journalize the adjusting entries on December 31,2018.

2.Prepare the December 31,2018 adjusted trial balance.Use a proper heading.

Correct Answer:

Verified

Q157: An adjusting entry that debits Accounts Receivable

Q161: If net income is overstated,equity will be

Q164: Deborah Consultants had the following accounts and

Q165: Adjusting entries do not update balance sheet

Q166: All of the accounts and the account

Q169: The unadjusted trial balance of James Business

Q172: The adjusted trial balance shows _.

A) account

Q175: If a company fails to make an

Q178: The accountant for Barnes Auto Repair Company

Q179: Financial statements are prepared from the balances

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents