Gaines Corporation invested $114,000 to acquire 24,000 shares of Owens Technologies,Inc.on March 1,2018.On July 2,2019,Owens pays a cash dividend of $3.25 per share.The investment is classified as equity securities with no significant influence.Which of the following is the correct journal entry to record the transaction on July 2,2019?

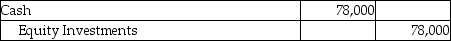

A)

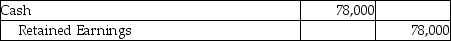

B)

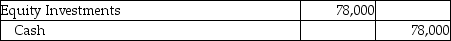

C)

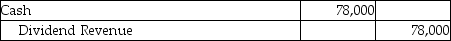

D)

Correct Answer:

Verified

Q81: National Corporation has excess cash to invest

Q82: When a company receives a dividend payment

Q83: Gardens,Inc.invests its excess cash in Innovative Technologies,Inc.and

Q84: Short Company owns a 2% investment in

Q85: Autumn Services,Inc.acquired 140,000 shares of Spring Metals,Inc.on

Q86: Franklin Corporation invested $100,000 to acquire 20,000

Q88: Which of the following statements regarding debt

Q89: For each of the following transactions related

Q90: Gain on Disposal of Equity Investments is

Q96: On the maturity date of a bond

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents