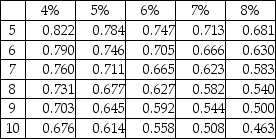

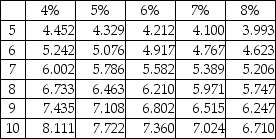

The face value of a bond is $71,000,its stated rate is 7%,and the term of the bond is five years.The bond pays interest semiannually.At the time of issue,the market rate is 8%.Determine the present value of the bonds at issuance. Present value of $1: Present value of ordinary annuity of $1:

Present value of ordinary annuity of $1:

A) $50,844

B) $20,156

C) $68,152

D) $71,000

Correct Answer:

Verified

Q182: When using the effective-interest amortization method,the amount

Q183: Generally accepted accounting principles require that interest

Q185: When using the effective-interest amortization method,the amount

Q186: Generally accepted accounting principles require that interest

Q189: On January 1,2019,Agree Company issued $85,000 of

Q190: The face value is $82,000,the stated rate

Q190: The process for calculating present values is

Q191: When using the effective-interest amortization method,the amount

Q191: Compute the present value of an ordinary

Q197: On January 1,2019,French Company issued $74,000 of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents