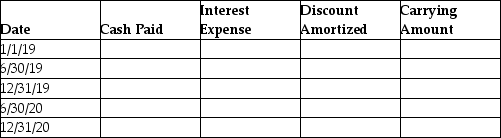

On January 1,2019,Parker Advertising Company issued $50,000 of six-year,3% bonds when the market interest rate was 4%.The bonds were issued for $47,356.Parker uses the effective-interest method of amortization for bond discount.Semiannual interest payments are made on June 30 and December 31 of each year.Prepare the amortization table for the first four interest payments.(Round your answers to the nearest dollar number. )

Correct Answer:

Verified

Ratinal:

Cash paid each inter...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q181: When computing a bond's cash flow for

Q182: When using the effective-interest amortization method,the amount

Q186: Generally accepted accounting principles require that interest

Q187: The effective-interest amortization method allocates an amount

Q201: Using the effective-interest amortization method,the calculation for

Q202: On January 1,2019,Castle Services issued $169,000 of

Q202: When a bond is issued at a

Q203: Using the effective-interest amortization method,the amount of

Q207: On January 1,2018,Ling Services issued $168,000 of

Q207: On January 1,2019,Eastern Services issued $140,000 of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents