Farrell and Jimmy enter into a partnership agreement on May 1,2018.Farrell contributes $60,000 and Jimmy contributes $120,000 as their capital contributions.They decide to share profits and losses in the ratio of their respective capital account balances.The net income for the year ended December 31,2018 is $70,000.Which of the following is the correct journal entry to record the allocation of profit? (Do not round any intermediate calculations.Round your final answers to the nearest dollar. )

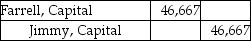

A)

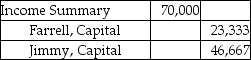

B)

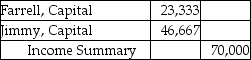

C)

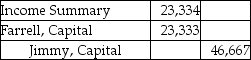

D)

Correct Answer:

Verified

Q62: Dana and Emile allocate 2/3 of their

Q63: Which of the following statements is TRUE

Q65: Andre,Beau,and Caroline share profits and losses of

Q66: Adam,Bill,and Charlie are partners.The profit and loss

Q70: Adam,Bill,and Charlie are partners.The profit and loss

Q72: Farrell and Jimmy enter into a partnership

Q75: If the partnership agreement specifies a method

Q76: The withdrawal accounts of a partnership are

Q79: Felix and Ian allocate 2/5 of their

Q80: Bob and Bill allocate 2/3 of their

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents