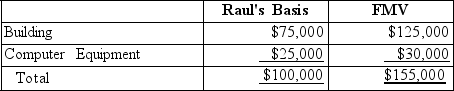

Raul contributes the following assets to a partnership for a 50% interest:  What is Raul's basis in his partnership interest?

What is Raul's basis in his partnership interest?

A) $100,000.

B) $155,000.

C) $50,000.

D) $0.

Correct Answer:

Verified

Q7: Ordinary income from a partnership is not

Q11: The term "step-into-the-shoes" means that the partnership

Q13: All income/gain and expense/loss items affect a

Q15: Typically,a partner does not recognize a gain

Q18: All income and expense items of a

Q22: Lacy contributes the following assets to a

Q24: Which of the following is reported as

Q25: When a partner increases his or her

Q26: If a partner contributes services on the

Q38: A pre-contribution gain occurs when a partner

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents